Can Sustainable Investments Make a Difference?

Alum News

Published March 25, 2020

One often overlooked avenue for driving progress in the environment and society is through sustainable and impact investing—terms that refer to the pursuit of positive social, environmental or other change using investment capital.

When weighing potential investment opportunities, there’s a misconception that you can only get “real” impact from a targeted, private investment, such as providing seed capital to a clean-tech startup or lending capital to small farms. While investing locally can be a powerful way to make a difference, thinking globally can be another. The public equity and debt markets can be incredibly important avenues to make change on a global scale, and importantly, they are more accessible than private investments, which may only be available for “accredited” and “qualified” purchasers.

In 2016, for example, the International Energy Agency (IEA) stated that nearly $75 trillion would be needed by 2040—$40 trillion in energy supply investments and $35 trillion in energy efficiency—to hold atmospheric carbon dioxide to a level that the IEA believes gives us a chance of limiting global warming to 2 degrees Celsius. This finding requires mobilizing capital on a massive scale, and the most likely way to get there is through the public equity and debt markets. Other channels of funding simply may not be sufficient.

How exactly can this be carried out in the public markets? First, individuals can be selective and buy stock in companies with positive sustainability strategies and bonds that are funding sustainable infrastructure. Second, individuals can be proactive owners in their investments through proxy voting and other means of engagement to express how they want companies to conduct their affairs in a more sustainable manner.

Targeting companies and projects that have a positive impact on the environment is a powerful way to deploy capital. Moreover, there’s evidence that investing with sustainability in mind has the potential to outperform the broad markets. For example, Arm Holdings, a software design company, came to dominate the smartphone market by focusing on energy efficiency rather than pure computational power and speed, and WhiteWave Foods achieved growth through its focus on organic and minimally processed foods. Both demonstrated how businesses can create financial value through sustainability (and both firms were acquired at premium valuations several years ago). Ecolab is another example. In 2018 alone Ecolab’s products and services helped conserve 188 billion gallons of water—all while helping its customers save money and delivering a 16 percent compound annual return to its investors over the past 10 years.

Debt markets can also fund effective environmental projects. For example, Denver Water is a utility serving 1.4 million residents of Greater Denver. The region’s vulnerability to climate change–related drought could lead to a gap in water supply as its population grows. To help ensure long-term water availability, the utility issues bonds to help initiatives such as reservoir expansion, water recycling and conservation. As a result, water use has increased just 6 percent since the early 1970s, even though the population Denver Water serves has grown by 50 percent in that time frame.

Investors also have a variety of tools at their disposal that can help influence companies. For example, individual shareholders can have their say on company matters through proxy voting. By voting shares proactively, individuals can help steer corporate decisions on various environmental, social and ordinary business proposals. Investors can also engage directly in dialogue with companies to voice their views, or pledge their shares to larger negotiation efforts with investor networks that specialize in shareholder advocacy.

In short, public equity and debt markets can offer a growing number of opportunities for individuals to back many of the most promising solutions that address critical sustainability challenges. And these publicly traded opportunities are available to all investors, not just specialists or large-asset owners.

So, what’s invested in your retirement and brokerage accounts?

This story appears in the Spring 2020 issue of the Smith Alumnae Quarterly.

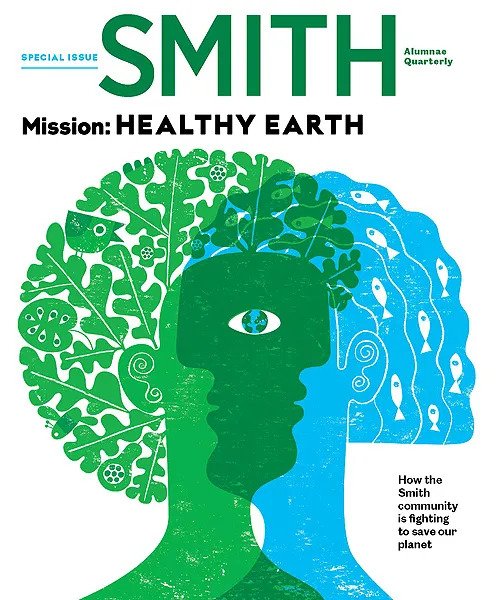

SMITH ALUMNAE QUARTERLY

Special Climate Issue

Mission: HEALTHY EARTH

How the Smith community is fighting to save our planet

SMITH ID

EMILY DWYER ’13

SUSTAINABILITY RESEARCH ANALYST: Brown Advisory

SMITH MAJOR: Economics, environmental science and policy

Illustration by James Yang